Explore the tabs to the right for all the information you need about Pay & Benefits.

If you have more specific or individual questions, concerns regarding your own pay and benefits reach out to the following departments:

Payroll Department

national.payroll@publicoutreachgroup.com

Benefits Department

benefits@publicoutreachgroup.com

For your records: Onboarding Paperwork

Evaluations, Check-ins and Pay Reviews

The People & Culture Department provides training, support, tools and documentation for all performance reviews.

If you have questions about any aspect of the review process (including informal check-ins and formal pay-reviews) do not hesitate to contact People & Culture at peopleandculture@publicoutreachgroup.com, 1 888 325-5535 x4000.

Feedback, Check Ins, Informal & Formal Performance Reviews

Feedback is a gift, both to the employee, and to the company. Regular performance reviews are crucial for leadership development. Whether they are New Recruits, Probation Period Employees or post-probation period Employees, everyone is provided regular feedback on their performance outputs, leadership abilities, and overall fit within the company.

The goal for all employee reviews is to increase communication between the staff person and their direct manager. Staff must be provided feedback on their successes and on the areas where they may need improvement. Program/Fundraising Managers and Supervisors must work with staff to develop strategies to correct any performance issues as they arise. No staff person should ever be surprised by any feedback and/or should hear feedback on an issue for the first time during a Pay Review meeting. Staff must have the opportunity to provide feedback on their Manager’s performance as well.

An effective feedback system requires flexibility and creativity, so we’ve developed a variety of feedback mechanisms to best serve the needs of staff and the company.

New Recruit Evaluation Assessment Review

New Recruits sign an agreement that specifies the code of conduct, fundraising medium, the client they will represent, and the fundraising targets they must achieve. Training during this period includes Staff Orientation, Fundraising training, and Client training.

At the end of the evaluation period (typically one week) the New Recruit undergoes the Evaluation Assessment Review with their manager, where fundraising results and supervisor feedback is reviewed. The New Recruit is either hired, not hired, or has their evaluation period extended (one extension only). The Evaluation Assessment Period may be terminated without notice at the discretion of the Fundraising Manager.

Pay Reviews

The Pay Review is the formal review where an employee has the opportunity for a wage increase in their current position.

Each department has a unique pay-band and review process. If you require more information on the pay structurein your department contact People & Culture (peopleandculture@publicoutreachgroup.com, 1 888 326-5535 x4000).

Pay Stub Access With ‘Total Access’

Total Access gives you easy to use, direct access to all your previous pay stubs and T4 information from your personal computer. Plus we reduce our paper waste!

Sign up at https://totalaccess.adp.ca.

Enter your personal information. Some details you may not have on you:

- Client #: 82327b

- Company Code: A0NT

- Employee ID: check your paper stub – in the bottom right-hand corner

- (Re)Hire date: if not sure, ask your FC

- Fill out all your security questions and create a password for yourself.

Detailed instructions on how to enroll follow. Not sure what something on your stub means? Check out the next section as well, How to Read Your Pay Stub.

Total Access Registration Form Guidelines

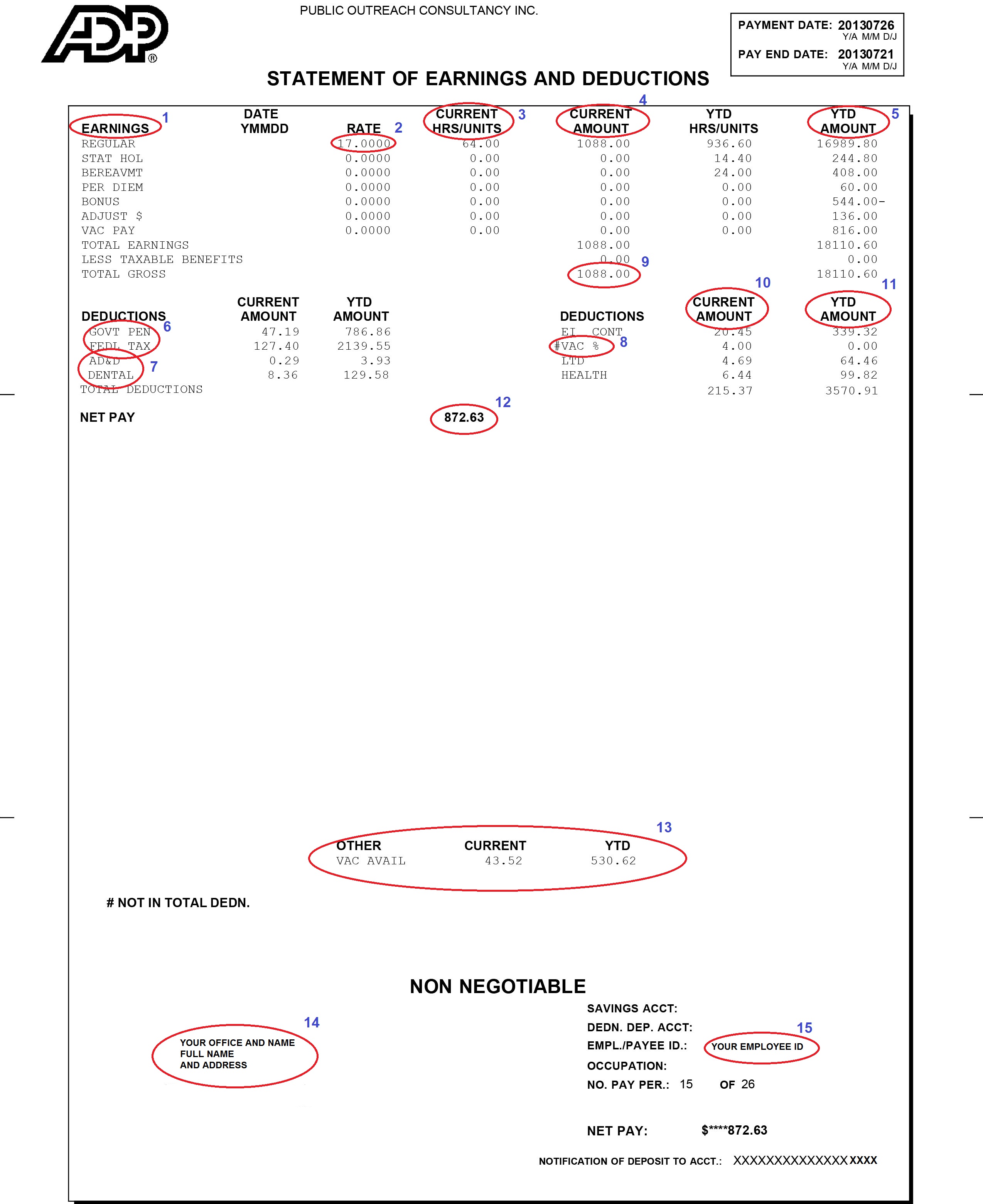

How to Read Your Pay Stub

“Retro” is used when payroll gets a pay band or eval pass notification from a previous pay period.

“Adjust $” is used when there are missing hours from a previous pay period, but the pay rate stays the same.

“Misc net” tracks deductions from pay for repayment of advances

“Bereavement” is pay that Public Outreach offers in the event that an immediate family member passes and you require time off work. Speak to your manager—they can OK up to 3 days off paid.

2 – Rate – This is your hourly rate—check your stub every once in a while to ensure it’s where you expect!

3 – Current Hrs/Units – This is total hours you worked in the pay period. If you’re not sure what the pay period dates are, look at the top-right corner of the stub. Pay End Date is the last day of the period. The first day is two Mondays back.

4 – Current Amount – This is the gross amount of your pay, whether it comes from your regular hours, vacation pay, per diem, etc. No deductions (taxes, benefits) have been made from the totals in this column. At the bottom of this column, all payable amounts are totaled (see #9). These numbers are only related to this stub’s pay period.

5 – YTD Amount – This where all monies you have been paid to this point are listed. YTD means “Year to Date”. Anything that was ever in the “Earnings” column will be listed here for the entirety of each calendar year.

6 – Govt Pen etc – Govt Pen, Fedl Tax and EI Cont are all taxes which are automatically deducted from all income.

7 – AD&D, Dental, Health etc – If you have benefits, you will see these deductions on your cheque each pay period.

8 – VAC % – Per Employment Standards, all employees receive 4% of their wages as vacation time—this equates to 10 days over a calendar year.

9 – Total Current Amount – All payable items on this pay period (see #4 for full explanation of Current Amount).

10 – Current Amount – Current amounts for deductions are also listed for each pay period. Total Current deductions are summed below.

11 – YTD Amount – YTD amounts for deductions are also listed. Total YTD deductions are summed below.

12 – Net Pay – Your Net Pay is the final total—the total Current Amount minus your total Current Amount of deductions. This is the number that will actually go into your bank account.

13 – Vacation Totals – The amount of vacation you accrued this pay period is listed along with your current and total amount of vacation available. You may request to use this vacation pay in lieu of actual hours if you have taken time off of work. Read up all about vacation pay under Paid/Unpaid Time Off in the menu above.

14 – Your Name and Address – Pretty self-explanatory. Check this once in a while! Your address should be up to date so that we can mail you your T4 as well as eventually your Record of Employment.

15 – Your Employee ID – If you ever need it, the set of numbers at the end of this string is your employee ID. This is also part of your policy or certificate ID number if you’re on extended benefits.

Attendance

As a staff person you are expected to attend the work place, which may include the office or the specified fundraising location. The work place for the majority of employees is the designated “on turf” fundraising location which may be an intersection, a bus stop, a restaurant etc. Employees must receive permission from their line manager before they are able to conduct any work that is different from the designated work place.

When an Employee is absent three consecutive working days without reporting, the Employee will be considered to have resigned and will be terminated from the payroll.

Lateness

An employee is considered to be late if they report for work after the scheduled start time. This includes arriving late at the place of work / designated offsite meeting location at the beginning of the shift or returning late from a meal or other break during the shift.

Paid Breaks and Unpaid Meal Breaks

The spirit of the paid breaks that are offered to staff is to allow staff who have been working for an extended period of time to take a breath, clear their minds, use the washroom, walk around the block etc., so that they can get back to working as quickly as possible, refreshed and alert.

Each department and office develops a break policy that is periodically reviewed and adjusted.

Generally:

Paid Breaks

- are not mandatory for the staff person to take

- are not obligatory for the manager to provide

- must not exceed 15 minutes per four hours of work.

- cannot be used to shorten the duration of the workday

- are sometimes combined to lengthen the unpaid meal break

- smokers do not get additional breaks

Unpaid Meal Breaks

Meal breaks are 30 minutes unpaid and are to be taken when the work day exceeds 5 hours.

Paid/Unpaid Time Off

List of Canadian Stat Holidays by Province

Paid / Unpaid Time Off

There are different situations where staff need to take (paid or unpaid) time off from their regular duties. The most typical time staff take off is paid Vacation Time which is provided as a benefit to staff through employer contributions.

There are other instances where a staff person may take unpaid time off for non-statutory (non emergency) reasons which must be approved by / are at the discretion of the direct manager.

Paid & Unpaid Leaves must be approved, typically in writing, with as much advance notice as possible.

Paid & Unpaid Statutory Leave (Family Medical, Medical Emergency, Bereavement Leave etc.)

All Staff are allowed to take an unpaid leave of absence to deal with such matters as illness, death in their immediate family and other unexpected events in accordance with the employment standards legislation in the province in which they work (ie “Family Responsibility Leave”, “Bereavement Leave”, “Family Medical Leave”).

Staff must inform their manager when intending to take such leaves with as much notice as possible, and may be required to produce documentation such as a doctor’s note.

Public Outreach may give consideration, in very special cases and at the discretion of the People & Culture Department, to allowing such leaves to extend beyond the statutory allowance.

Overtime Proceedures

Staff feedback has shown that one of the best aspects of working at Public Outreach is flexibility with work schedules. As an ethical employer we also want to help staff maintain a healthy work/life balance. Some people get addicted to work and it’s our job to make sure staff aren’t working too many hours each week. To ensure a healthy work/life balance, Public Outreach must also have clear boundaries on how much each staff person may work. Below is our Overtime Policy by province (regulations differ), and as you will see, no staff person is permitted to work overtime hours without advance written permission by a senior manager AND our Human Resources department.

- British Columbia

- Alberta

- Ontario

- Québec [English]

- Nova Scotia

BC MSP Reimbursement Program

Public Outreach supports staff health and wellbeing through several different benefits programs, including the BC MSP Reimbursement Program.

Public Outreach reimburses payments made to the British Columbia Medical Services Plan (BCMSP) for eligible staff.

WHAT is the British Columbia Medical Services Plan (BCMSP) premium?

Residents of British Columbia are required to pay monthly premiums for their provincial health care coverage, known as the BC Medical Services Plan (BCMSP).

Staff must have valid provincial medical coverage before they can be covered through the Public Outreach’s health/dental benefits provided through ClaimSecure.

HOW MUCH does Public Outreach reimburse?

Public Outreach will reimburse eligible staff 100% of the premiums they pay for their own personal MSP coverage.

WHO is Eligible?

To be eligible for reimbursement under Public Outreach’s BC MSP Program, individuals must:

- be a resident of British Columbia and covered under the British Columbia Medical Services Plan (BCMSP);

- have worked continuously for Public Outreach for 6 months preceding the month for which they are seeking reimbursement;

- have worked an average of 22.5 hours per week in the 6 months preceding the month for which they are seeking reimbursement;

- not have their premiums already covered through another organization or employer; and

- be currently employed with Public Outreach.

HOW do I Apply for Reimbursement?

It’s Easy! Submit your proof of payment to Public Outreach’s Payroll & Benefits office, along with your full name and current contact information including address, phone number and email address :

By email: benefits@publicoutreachgroup.com

By mail: Payroll & Benefits, 347 College St., 3rd Floor, Toronto, ON M5T 2V8

Don’t have Proof of Payment? Contact BCMSP with the Ministry of Health to find out how to obtain proof of payment:

British Columbia Medical Services Plan

Health Insurance BC

Metro Vancouver: 604 683-7151

Toll-free: 1 800 663-7100

http://www.health.gov.bc.ca/msp/

Please note that reimbursement is not automatic. Staff must meet the eligibility requirements and submit an acceptable proof of payment in order to receive a reimbursement.

WHAT’s the deadline for Submitting Proof of Payment?

The reimbursement period has an annual cut-off. ANY reimbursements for the current calendar year must be submitted by Jan 15 of the following year to be eligible.

Any premium payments submitted after the deadline will not be reimbursed.

WHEN does the Public Outreach BC MSP Program Start?

The Program will begin reimbursing applications that apply to January 2015 premiums. Public Outreach will not reimburse BCMSP premium costs for months prior to January 2015, or pay arrears for months prior to January 2015.

How will I receive the Reimbursement?

Your reimbursement will be paid through your regular pay.

Is BC MSP Reimbursement is a Taxable Benefit?

The BC MSP reimbursement is considered a taxable benefit, which means that staff will be taxed on the value of their MSP reimbursement. A taxable benefit is a benefit provided to an employee by an employer that has to be added to the employee’s income each period to determine the total amount that is subject to taxes and other deductions.

Employment Insurance (EI) and Canada Pension Plan (CPP) deductions will also be deducted from the value of the reimbursement.

Will Public Outreach reimburse my BCMSP premiums if I go on an approved unpaid Leave of Absence?

If your leave of absence is considered to be a statutory leave of absence and has been approved in writing by the Fundraising Manager or Senior Fundraising Manager, then you may be eligible to receive reimbursement for your premium costs for the duration of your leave. Please note that you must meet the eligibility requirements outlined above.

Will my premium costs be reimbursed if my employment with Public Outreach ends?

Public Outreach will not accept reimbursement requests submitted after your last official day of work, even if the requests pertain to months when you were employed with Public Outreach.

For RETURNING EMPLOYEES: If you’re rehired with Public Outreach within 12 months of your last day of work, and previously received the Public Outreach BC MSP reimbursement, your waiting period will be reduced to 3 months.

Important Note: Public Outreach does not administer BCMSP on behalf of staff. Staff are responsible for administering their own BCMSP with the Ministry of Health. Public Outreach’s BC MSP Program provides a benefit to staff through reimbursement of premiums only.

Public Outreach has the right to modify, reduce, and/or terminate benefits provided under the Public Outreach BC MSP Reimbursement Program.

Have Questions?

There’s always someone to contact:

- your local Fundraising Coordinator;

- Payroll & Benefits at 1 888 326-5535 ext. 3317; or benefits@publicoutreachgroup.com

- Human Resources at 1 888 326-5535 ext. 4000; humanresources@publicoutreachgroup.com

FAQ on the BC MSP Reimbursement Program

Does Public Outreach administer or manage my BC MSP for me?

No, you are responsible for administering or managing your own MSP with the BC Ministry of Health. You would enrol for BCMSP directly with the Ministry of Health, and self-administer your own plan, including premium payments and reporting changes like a new address.

The Public Outreach BC MSP Program is a Reimbursement Program only. Public Outreach provides reimbursement for premiums that existing staff have already paid to the Ministry of Health’s BCMSP for their own personal coverage.

How can I sign up for BCMSP with the Ministry of Health?

The Ministry of Health says that enrolment with MSP is mandatory for all eligible residents. To apply, you need to fill in an Application Form and provide it to the Ministry of Health.

Application Form Link: https://www.health.gov.bc.ca/exforms/msp/102fil.pdf.

Application Form Info Link: https://www.health.gov.bc.ca/exforms/msp/enrolment.html

For information on eligibility requirements, how to apply, payment and more please refer to the BC MSP website at to http://www.health.gov.bc.ca/msp/infoben/eligible.html#enroll

You can also contact the Ministry of Health by phone to get answers to your questions.

Medical Services Plan – Health Insurance BC

Monday to Friday, 8:00 am to 4:30 pm PST (except statutory holidays)

Metro Vancouver: 604 683-7151; Toll-free: 1 800 663-7100

What does Public Outreach need from me to process my reimbursement?

Public Outreach requires a copy of the monthly invoice that the Ministry of Health sends you regarding your BCMSP. Your monthly invoice confirms that you’ve made payments for your own personal BCMSP premiums in previous months. For instance, we would look at your February invoice to confirm that you’ve paid for your January premium. If you do not receive copies of your monthly statements and/or invoices, you can sign up for on-line access to your payment information at:

http://www.sbr.gov.bc.ca/individuals/Customer_Service/MSP/online_services.htm

Need more Information? Contact…

- Your local Fundraising Coordinator

- Payroll & Benefits at 1 888 326-5535 ext. 3317 or benefits@publicoutreachgroup.com

- Human Resources at 1 888 326-5535 ext. 4000 or humanresources@publicoutreachgroup.com

Extended Health Benefits

For news and information, contact any one of our Benefits Administrators at benefits@publicoutreachgroup.com or 1 888 326 5555 x 3305. You are eligible for benefits after working with Public Outreach for 6 months at a minimum of 22.5 hours per week. Each staff person should receive an email from our Benefits Administrators when they’re eligible. If you think you are and have not received an invitation, contact them!

New! You can now check your benefits coverage on your phone. ClaimSecure now has My Coverage Mobile, accessible once you’ve signed up for an eProfile. For instructions on how to submit claims, review the section below, How to Make Claims!

New! You can now check your benefits coverage on your phone. ClaimSecure now has My Coverage Mobile, accessible once you’ve signed up for an eProfile. For instructions on how to submit claims, review the section below, How to Make Claims!

For the ClaimSecure Extended Healthcare Benefits fact sheet and policy information, click here.

Looking for the ClaimSecure application form? Download it here.

Looking for the ClaimSecure Benefits Manual? Download it here.

A friendly explanation of how to claim benefits.

Before anything else happens, be sure you have benefits! You should have a card with your group and certificate ID. If you have any questions feel free to email benefits@publicoutreachgroup.com

Register for online services

Go to Claimsecure.com, click on their eProfile Account Login and select member.

If you lose your password or otherwise need help with benefits you can call 1-888-513-4464 to speak to someone with Claimsecure who can assist.

Registering includes a ‘wellness profile’ which lets Claimsecure periodically email you with info pertaining to the categories you select. This is voluntary and confidential and does not, based on the authors own experience, result in lots of spam.

Return to the eProfile Account Member Login and, well, login!

My Account

My Account

Add your direct deposit information. (Don’t know your bank info? Ask a canvasser how to find out!) Make sure your email is set up as Claimsecure will email you to notify you when they have received and processed your claim.

Paper Submission

Go to the ‘my forms’ tab and print the appropriate form fill it out and mail it to Claimsecure, along with required supporting documents. Be sure to keep copies of anything you send in. Their address is

Go to the ‘my forms’ tab and print the appropriate form fill it out and mail it to Claimsecure, along with required supporting documents. Be sure to keep copies of anything you send in. Their address is

Claimsecure

PO Box 6500 STN A

Sudbury On P3A 5N5

Typically required supporting documents are any receipts for reimbursement and a prescription/recommendation from a medical professional. Check the “Benefit Booklet” under the “Request More Information” tab for more specific information on each type of claim. Make sure any receipts sent in have the provider’s registration number.

Online Submission

You have the option of online submission. Online submission is typically faster but there are limitations as to what can be submitted. Online submission is only available for some types of claims. You may receive an error message requiring you to file your claim by mail, in which case follow the steps above for submitting a claim by mail. Click on the My Claims tab and hit submit claim. After the terms and conditions, take a moment to verify that the information displayed is correct. Then select your type of claim and then hit next.

You have the option of online submission. Online submission is typically faster but there are limitations as to what can be submitted. Online submission is only available for some types of claims. You may receive an error message requiring you to file your claim by mail, in which case follow the steps above for submitting a claim by mail. Click on the My Claims tab and hit submit claim. After the terms and conditions, take a moment to verify that the information displayed is correct. Then select your type of claim and then hit next.

If you have not submitted a claim before, you will first have to search or add your provider (the masseuse/dentist etc). You will need the address, phone number and full name of your provider.

Pay attention for any notices requiring you to submit receipts and doctor’s notes. If you do not have receipts on hand, you have up to 30 days from the date of submission to upload them or mail them in. Be sure to keep copies for your own records if you are mailing documents, otherwise your ability to submit online in the future to be suspended.

Pay attention for any notices requiring you to submit receipts and doctor’s notes. If you do not have receipts on hand, you have up to 30 days from the date of submission to upload them or mail them in. Be sure to keep copies for your own records if you are mailing documents, otherwise your ability to submit online in the future to be suspended.

Click on the Manage Receipts section under My Claims to upload receipts if you do not do so during claim submission.

After you hit submit claim you can go to my claims and click view claims to see a record of claims you have filed. If you made a mistake and do not want that claim paid out, go to reverse claims and select the claim(s) you wish to reverse.

”What is Coordination of Benefits (CoB)?” This refers to how much your other insurance providers are reimbursing you for. If you have coverage from some place outside of PO (parents, spouse, school, etc.) be sure to have your group/policy # and member/certificate # handy so that Claimsecure can coordinate with your other benefit provider (see what they did there?) to give you the maximum reimbursement possible. If the system asks for a CoB amount, it refers to how much you have/are going to receive from your other insurance providers. It is illegal to claim for over 100% of the cost of a service (i.e. by submitting to multiple insurance companies without providing CoB info). Fraud is bad.